The Trillion-Dollar Coin: A Conceptual Solution to U.S. Debt Crises

Introduction

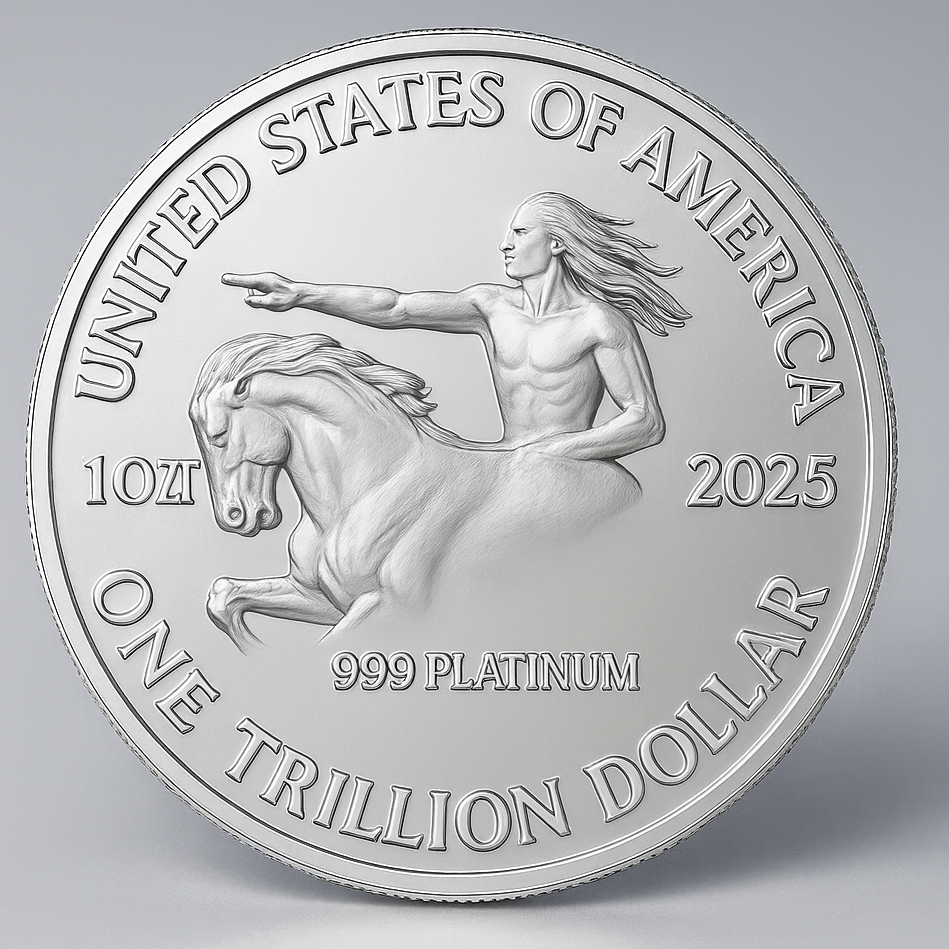

With increasing uncertainty and a government in shutdown, with no solution in sight, one unconventional option has again entered public debate: minting a platinum coin and depositing it at the Federal Reserve to reduce the national debt.

As of 2025, the U.S. defense budget has surpassed 925 billion dollars, approaching 1 trillion. By comparison, the federal interest expense on the national debt reached 1.2 trillion dollars in the same year. With total debt now exceeding 37 trillion dollars, interest payments alone have outgrown the entire defense budget.

This imbalance is a warning sign that the United States, still the world’s only true superpower, must take its fiscal trajectory seriously and consider mechanisms to restructure or stabilize its debt.

What Is the Trillion-Dollar Coin?

The trillion-dollar coin is a conceptual workaround to U.S. debt-ceiling crises, first popularized during the 2011 debt-limit standoff.

It exploits a legal loophole in 31 U.S.C. § 5112(k), which gives the Treasury Secretary authority to mint platinum coins of any denomination without Congressional approval. Other forms of U.S. currency are subject to legislative limits, but platinum coins are not.

How It Would Work

Proponents suggest that the Treasury could:

- Mint a single platinum coin with a face value of 1 trillion dollars.

- Deposit it at the Federal Reserve, which would credit the Treasury’s account.

- Use those funds to meet government obligations such as salaries, social programs, and debt payments, without raising the statutory debt ceiling.

This maneuver would not create new money in a way that fuels inflation, since the Federal Reserve would handle the accounting and manage liquidity as needed. It is essentially an accounting tool that allows the government to access spending authority already approved by Congress.

Historical Context and Renewed Interest

The idea resurfaced during debt-ceiling battles in 2013, 2021, and 2023, often supported by certain economists and Democratic lawmakers as a last-resort option to avoid default. Critics, however, have dismissed it as gimmicky or potentially destabilizing for financial markets.

Although never implemented, the concept was discussed in Justice Department memos during the Biden administration.

In 2025 the debate has reignited. Some have suggested that President Trump could issue such a coin to address the record-high 37 trillion dollar debt, possibly tying it to ideas such as gold revaluation or decoupling from the Federal Reserve. Much of the current discussion remains speculative or meme-driven, mixing economics with political satire.

Related Developments and Controversies

In October 2025, the U.S. Treasury announced plans for a commemorative 1 dollar coin featuring Donald Trump’s image to mark the 250th anniversary of U.S. independence in 2026.

This sparked controversy because U.S. law traditionally forbids depicting living presidents on currency. Some have suggested that alternative figures, such as one of the Founding Fathers or Native American leaders like Crazy Horse, would be more appropriate.

The trillion-dollar coin images circulating online are mostly satirical, making fun of government debt, inflation, and political showmanship.

Technical Aspects and Broader Implications

Despite its dramatic framing, U.S. government spending remains regulated by congressional budgets, meaning that such a move would not lead to uncontrolled money printing.

Since the United States borrows in its own currency, there is no traditional need to repay the debt in foreign terms. The key is to maintain the U.S. dollar as the global reserve currency. That position is supported by America’s:

- strong consumer market

- leading innovation capacity

- and unmatched military power

By using a trillion-dollar coin to meet obligations without issuing new debt, the United States could in theory reduce interest costs and demonstrate fiscal resilience.

The coin would never circulate. It would exist only as a balance-sheet entry, a symbolic tool to balance the books.

No other country could replicate this without risking hyperinflation, as seen in Weimar Germany from 1921 to 1923 or more recently in Zimbabwe. Only the global confidence in the U.S. dollar allows this idea to be discussed seriously.

Conclusion

The trillion-dollar coin remains a controversial but legally possible fiscal instrument. It represents a mix of law, economics, and political theater.

Whether it is ever used or not, the idea highlights the growing tension between America’s fiscal reality and political gridlock, and the creative measures some are willing to consider to prevent the unthinkable: a U.S. default.